For those looking to build a rewarding career in the financial industry, becoming a Mortgage Loan Originator, or Mortgage Loan Officer, is an attractive and lucrative option. In Central Florida, a region marked by a thriving real estate market and a robust financial sector, the demand for skilled Mortgage Loan Originators is on the rise.

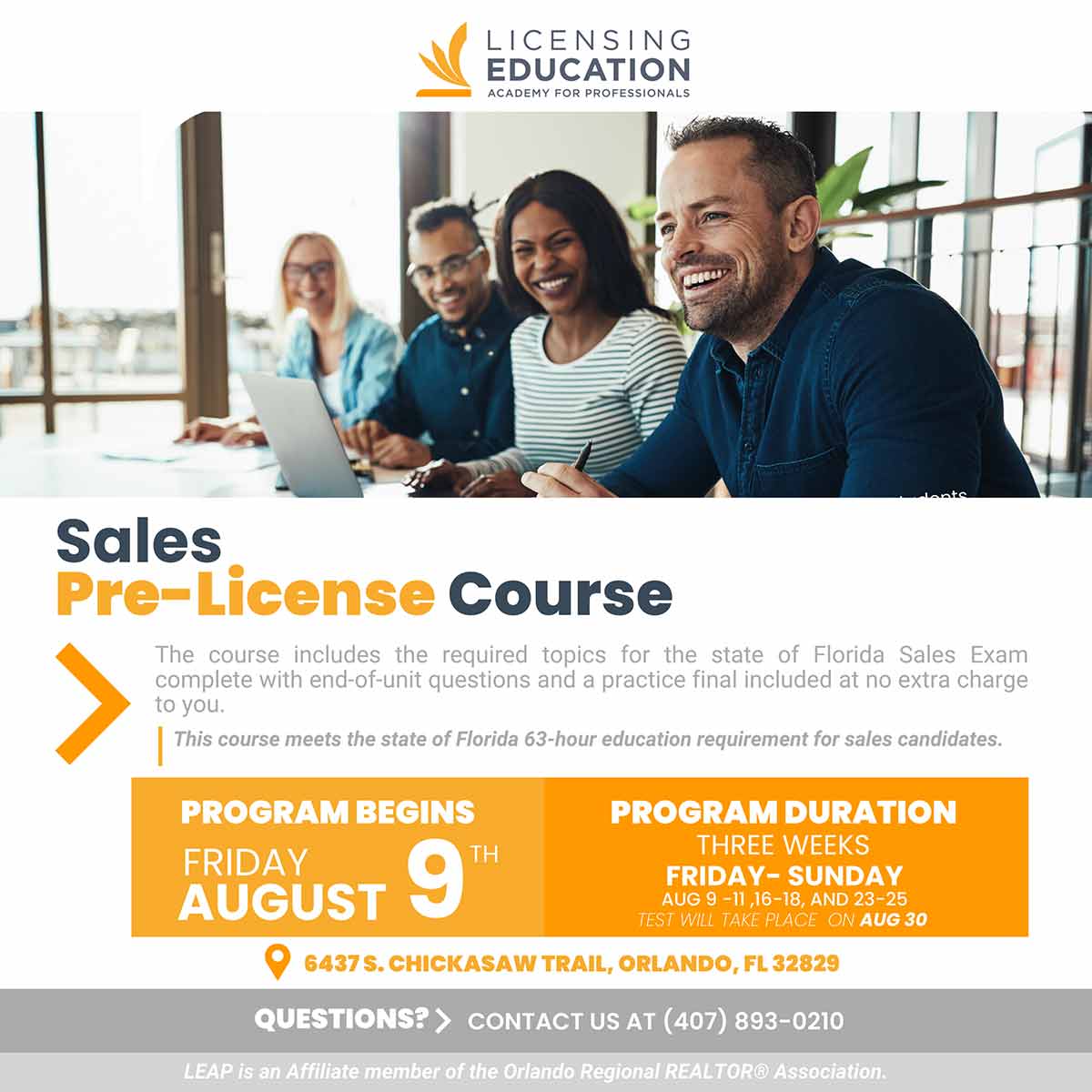

If you aspire to join this dynamic field, it’s essential to understand the fundamentals of becoming a Mortgage Loan Originator and the pivotal role of the Mortgage Loan Originator License Course, as offered by LEAP (Licensing Education Academy for Professionals).

Demystifying Mortgage Loan Origination

A Mortgage Loan Originator is a professional who plays a crucial role in the home-buying process. They work with individuals and families, helping them secure the financing they need to purchase their dream homes.

In Central Florida, where real estate transactions are frequent and diverse, the role of Mortgage Loan Originators is particularly significant.

Here are the essential steps to becoming a Mortgage Loan Originator:

Education and Training:

To begin your journey, you must complete the Mortgage Loan Originator License Course, offered by LEAP. This course provides you with the foundational knowledge required to excel in the field. It covers topics such as mortgage regulations, lending practices, and ethical standards.

Licensing Examination:

After completing your pre-license education, you’ll need to pass a state and federal licensing examination. This test assesses your understanding of mortgage origination principles, practices, and legal guidelines. Your success on this exam is a critical step toward obtaining your license.

Background Check and Credit Report:

As part of the licensing process, a background check and credit report will be conducted. It’s important to maintain a clean financial record and criminal history to meet these requirements.

Experience and On-the-Job Training:

Some states may have experience or on-the-job training requirements. Gaining hands-on experience by working with established Mortgage Loan Originators or within a financial institution can be invaluable.

State Licensing Application:

You’ll need to submit a state licensing application to your state’s regulatory authority, providing proof of your education, examination results, and any required experience.

Continuing Education:

Once you’ve obtained your Mortgage Loan Originator license, it’s essential to stay up to date with continuing education requirements. These ensure that you remain informed about evolving mortgage regulations and industry best practices.

The Role of a Mortgage Loan Officer License Course

The Mortgage Loan Originator License Course is the keystone to launching your career as a Mortgage Loan Originator.

At LEAP, our course is designed to equip you with the essential knowledge and skills required to excel in this field.

Here’s what you can expect from our program:

-

Comprehensive Curriculum:

- Our Mortgage Loan Officer License Course covers all aspects of mortgage lending, from federal and state regulations to ethical standards and best practices.

-

Experienced Instructors:

- Learn from professionals with real-world experience in the mortgage industry, who provide practical insights and guidance.

-

State-Specific Content:

- Our courses are tailored to meet the specific licensing requirements in Central Florida, ensuring you’re well-prepared for the state licensing examination.

-

Flexible Learning Options:

- Whether you prefer in-person classes or online learning, LEAP offers flexible course formats to accommodate your schedule and learning style.

Why Choose LEAP for Your Mortgage Loan Originator License Course

LEAP, Licensing Education Academy for Professionals, is dedicated to providing aspiring Mortgage Loan Originators with the highest quality education.

Our Mortgage Loan Originator License Course sets you on the path to success:

- Comprehensive Learning: Gain a deep understanding of mortgage origination principles and practices.

- State-Specific Expertise: We tailor our courses to meet Central Florida’s unique licensing requirements.

- Experienced Instructors: Learn from industry professionals who bring real-world insights to the classroom.

- Support for Your Career: We provide resources to help you find opportunities and excel in your career as a Mortgage Loan Officer.

Becoming a Mortgage Loan Originator in Central Florida is a promising career path, driven by the region’s vibrant real estate market.

Understanding the steps involved in acquiring your Mortgage Loan Originator license, along with the pivotal role of the Mortgage Loan Officer License Course offered by LEAP, is the key to your success.

The financial sector is ripe with opportunities, and LEAP is here to guide you through each stage of your journey toward becoming a licensed Mortgage Loan Officer in Central Florida.