Becoming a successful Mortgage Loan Originator (MLO) is an exciting journey filled with opportunities to help individuals and families achieve their dream of homeownership. To excel in this role, you need a unique set of skills that encompass finance, customer service, and industry knowledge.

This guide is your roadmap to understanding the key skills necessary for success in the world of Mortgage Loan Originator Pre-Licensing.

The Significance of Mortgage Loan Originators

Mortgage Loan Originators are crucial in the homebuying process. They serve as the link between borrowers and lenders, guiding clients through mortgage options, and ensuring they secure the best loan terms. Success in this role hinges on a combination of technical and interpersonal skills.

-

Financial Acumen

- In the world of mortgages, a fundamental skill for success is financial acumen. MLOs must have a deep understanding of mortgage products, interest rates, and financial markets. They help clients navigate loan terms, assisting them in making informed decisions about their financial future.

-

Communication and Customer Service

- Exceptional communication and customer service skills are paramount. MLOs work closely with clients, explaining complex mortgage terms and guiding them through the application process. Effective communication and a client-centered approach build trust and loyalty.

-

Analytical Skills

- Analytical skills are vital for assessing a client’s financial situation and determining the most suitable loan options. MLOs must be adept at reviewing financial documents, credit scores, and other relevant information to make recommendations tailored to each client’s needs.

Compliance and Ethical Standards

MLOs must adhere to stringent regulatory standards and ethical guidelines. Staying up-to-date with federal and state regulations is a necessity to ensure ethical lending practices.

Industry Knowledge

Mortgage loan origination is a dynamic field. Staying well-informed about industry trends, policy changes, and market dynamics is crucial for making sound recommendations and securing the best loan terms for clients.

This skill is essential for maintaining professional integrity and protecting clients.

Negotiation and Problem-Solving Skills

Negotiation skills are vital when working with lenders and advocating for clients. Problem-solving skills come into play when navigating complex loan scenarios or addressing issues that may arise during the mortgage process.

Attention to Detail

MLOs handle a myriad of paperwork and documentation, often with legal and financial implications. Attention to detail is essential to avoid errors that could delay the mortgage process or lead to compliance issues.

A Partnership with LEAP for Success

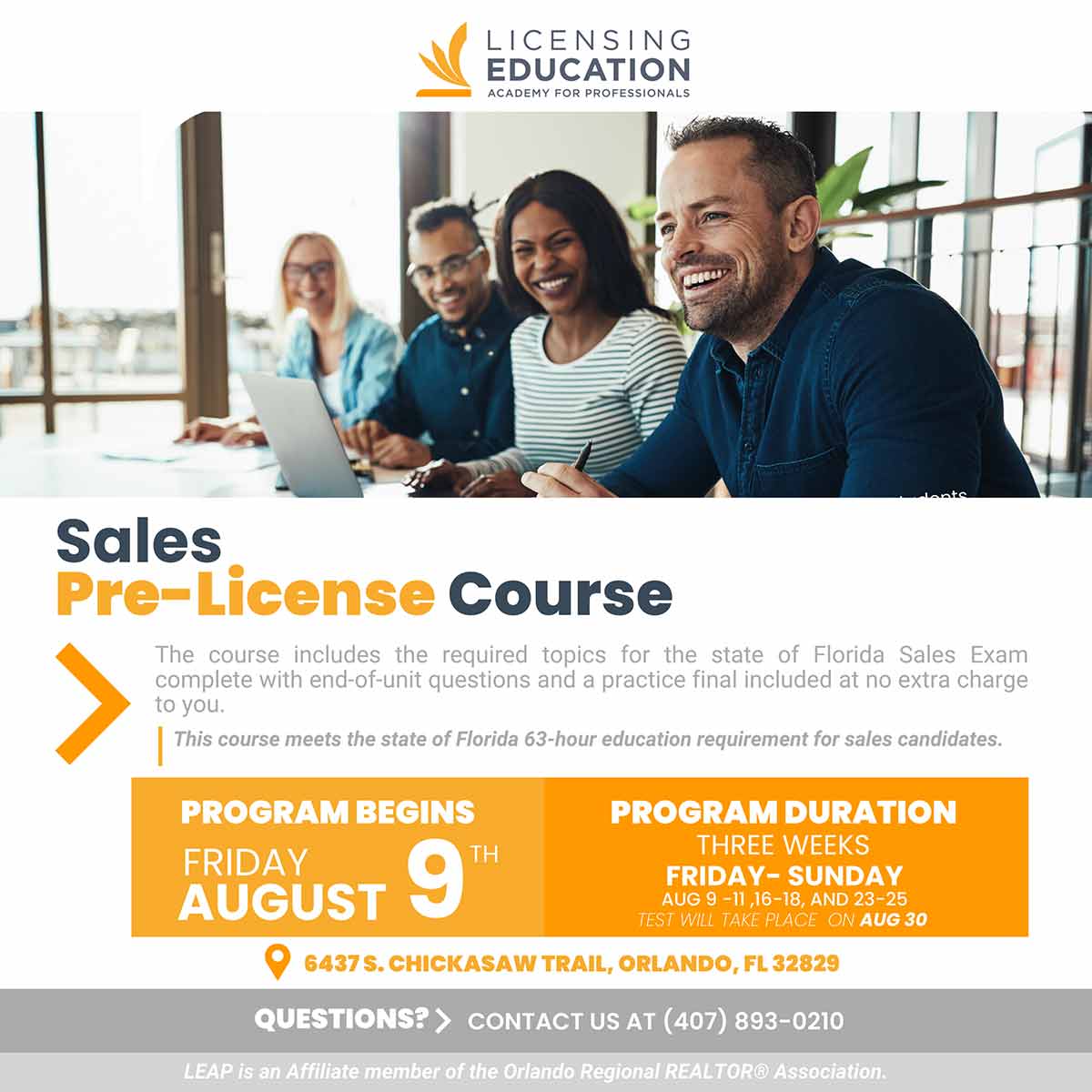

Mortgage Loan Originator Pre-Licensing is the first step in your journey to success in this rewarding field. At LEAP (Licensing Education Academy for Professionals), we offer comprehensive pre-licensing courses tailored to the requirements of Florida. Our expert instructors will guide you through the essential knowledge and skills needed to excel as an MLO.

Requirements and Licensing

Understanding the licensing requirements is the first step in your journey. In Florida, MLOs are required to complete pre-licensing education, pass the Nationwide Multistate Licensing System (NMLS) exam, and meet background check and fingerprinting requirements.

LEAP provides the education and support to fulfill these requirements and set you on the path to success.

Leap, Your Partner in Professional Excellence

Mastering the key skills for a successful Mortgage Loan Originator is your ticket to a prosperous and fulfilling career in the world of mortgages. As you explore this journey, remember that LEAP is here to guide you every step of the way.

Your future as a trusted and successful Mortgage Loan Originator begins with us.