The role of a Mortgage Loan Originator (MLO) is pivotal in the world of real estate, bridging the gap between aspiring homeowners and the financial resources they need.

At the Licensing Education Academy for Professionals (LEAP) in Orlando, FL, individuals can embark on a transformative journey to become skilled Mortgage Loan Originators, guiding clients toward their dream of homeownership.

The Role of a Mortgage Loan Originator: Architects of Financial Solutions

As a Mortgage Loan Originator, you are the architect of financial solutions, assisting clients in securing the funds necessary to purchase their homes. Your responsibilities include:

-

Financial Consultation:

- Conducting thorough financial assessments to understand clients’ needs and capabilities.

-

Loan Guidance:

- Advising clients on suitable loan options, explaining terms, and ensuring they make informed decisions.

-

Application Process:

- Assisting clients through the mortgage application process, navigating paperwork, and liaising with lenders.

-

Regulatory Compliance:

- Ensuring compliance with industry regulations and ethical standards in all transactions.

Benefits of Becoming a Mortgage Loan Originator

-

Financial Expertise:

- Develop a deep understanding of mortgage products, interest rates, and financial markets, positioning yourself as a trusted financial advisor.

-

Client Impact:

- Guide individuals and families toward their homeownership dreams, making a lasting impact on their lives.

-

Lucrative Career:

- Benefit from a potentially lucrative career with opportunities for commissions based on successful loan transactions.

-

Market Demand:

- As the real estate market continues to evolve, the demand for skilled Mortgage Loan Originators remains consistently high.

Your Journey with LEAP: Shaping Financial Success

LEAP’s comprehensive Mortgage Loan Originator courses are designed to equip aspiring professionals with the knowledge and skills needed to excel in this dynamic field. The curriculum covers:

-

Mortgage Fundamentals:

- Understanding the intricacies of mortgage types, interest rates, and financial calculations.

-

Regulatory Compliance:

- Navigating the legal and ethical landscape of mortgage lending.

-

Client Relationship Management:

- Developing effective communication skills to guide clients through the loan process with confidence.

-

Industry Insights:

- Staying abreast of market trends and industry changes to provide informed advice.

Industry Support and Partnerships

LEAP fosters connections with industry leaders, including Platinum Key Title, a full-service real estate title partner, and affiliations with the Orlando Regional Realtors Association (ORRA) and the National Association of Realtors (NAR).

These alliances provide a robust support network, enriching your journey to become a Mortgage Loan Originator.

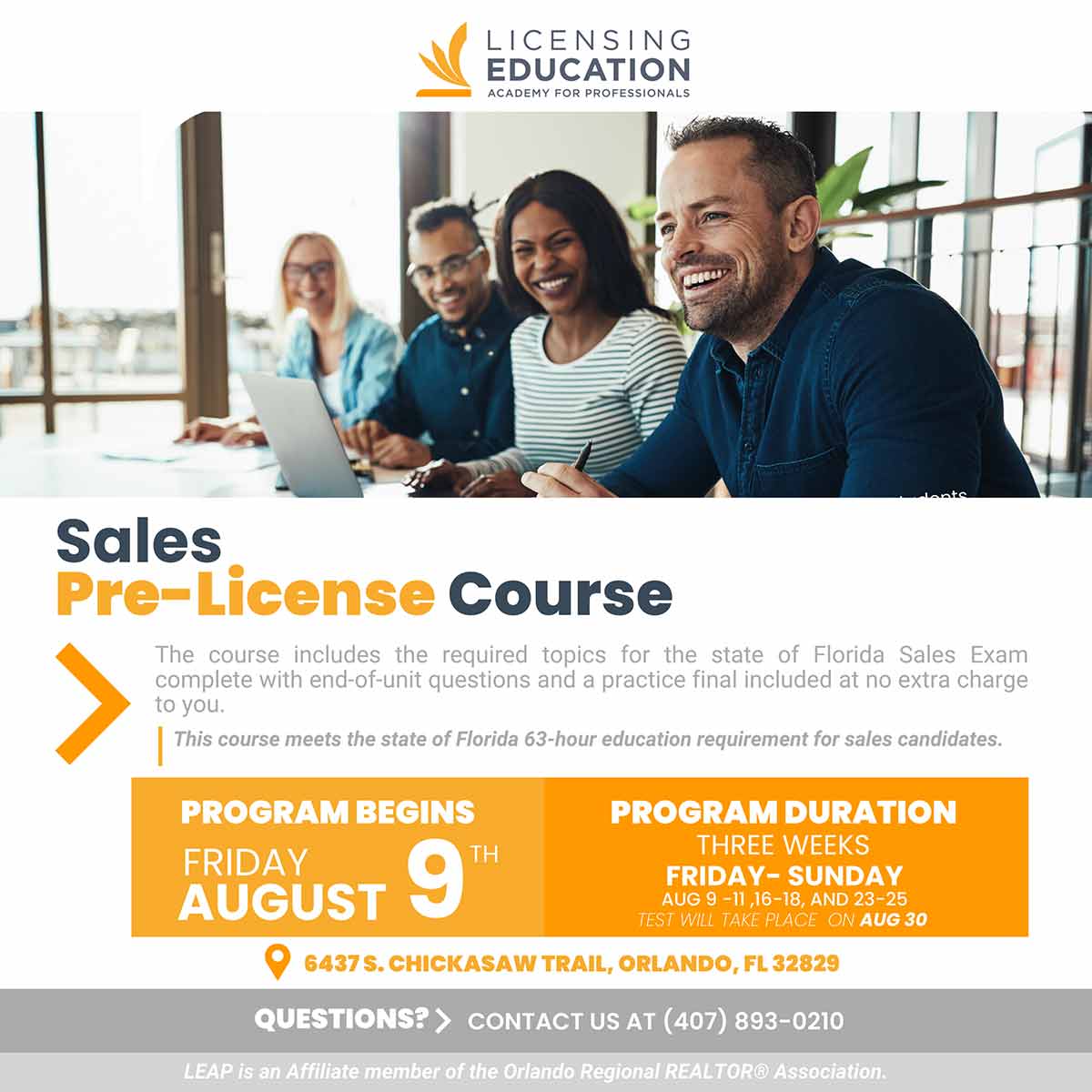

Sign Up Today for Your Future in Real Estate Finance

Take the first step toward a fulfilling career as a Mortgage Loan Originator. Sign up for LEAP’s courses in Orlando, FL, and unlock the potential to shape financial success for individuals and families on their homeownership journey. Your expertise as a financial architect awaits – start your transformative journey with LEAP today.